Here at ApplyInsights, we spend a lot of time discussing trends in Canadian education. Today, I’d like to shift our focus southward to the United States. We’ll kick off our US coverage with a look at which source markets increased their supply of students to the American market over the previous year and which ones went the other way.

Here’s what this blog post will cover:

- A breakdown by source region of trends in the flow of students to the US

- The 10 source countries with the greatest increase in students in 2019

- The 10 source countries with the greatest decrease in students in 2019

- The full list of the top 25 source countries for international students in the US, and how their student numbers shifted in 2019

All data used in this blog post is courtesy of the US Immigration and Customs Enforcement (ICE) . Totals include all F-1, M-1, and J-1 student visa holders across study levels.

Regional Trends for the US Student Market

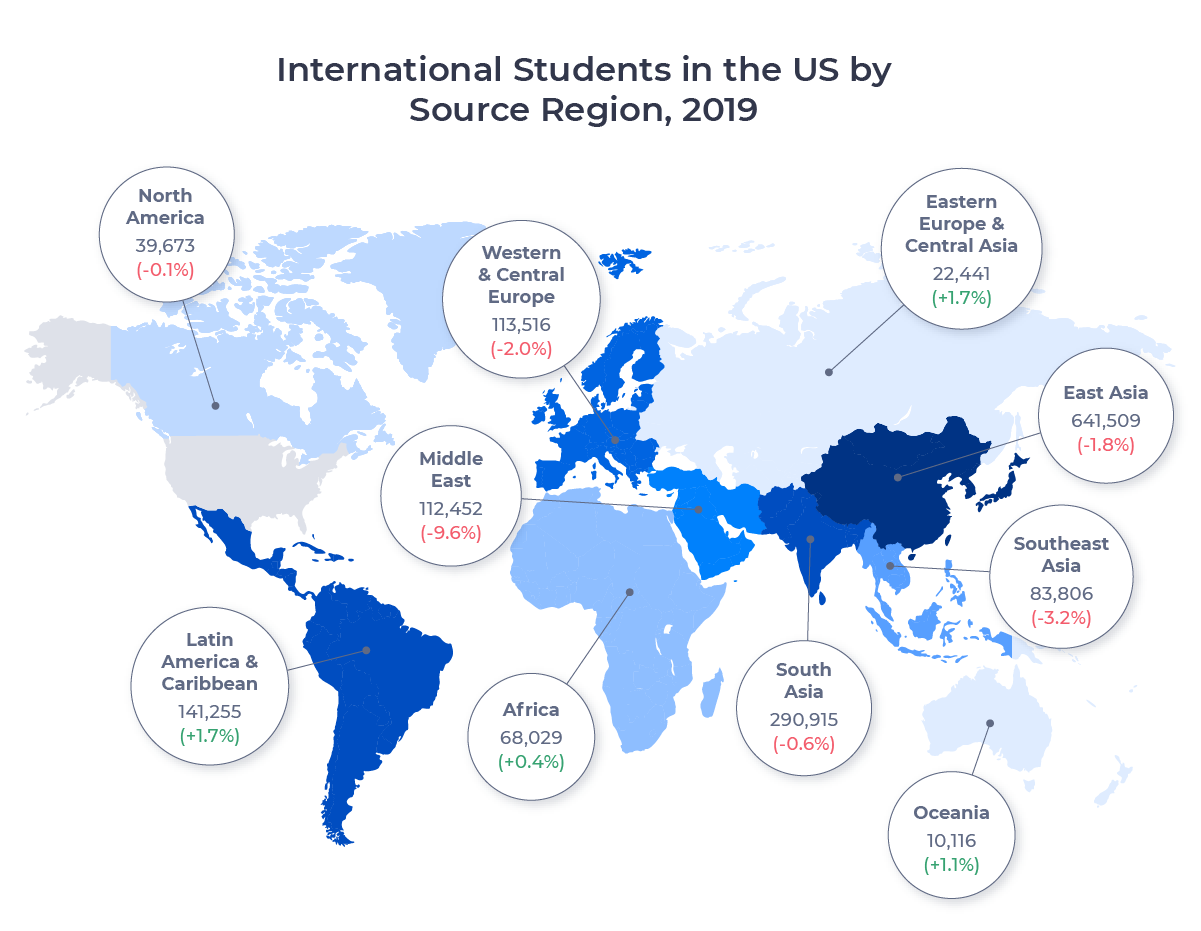

In 2019, more than 1.5 million students came to the United States from all across the globe. The US is by far the largest international student market in the world, but that market is shrinking. The number of international students in the US fell 1.8% in 2019, on the heels of a similar decline in 2018.

If we group source countries for the US market into larger source regions,1 we can see which areas send the most students to America, and where those contributions are growing and shrinking. The map below shows the number of students from each region who studied in the US in 2019, and the percentage change in the number students from the previous year:

More than 85% of the decrease in the US international student market last year came from the Middle East and East Asia. Student numbers from South Asia, Western and Central Europe, and Southeast Asia also declined. Only Latin America and the Caribbean saw an increase of more than 500 students.

Let’s examine some of these regions in further detail.

The Middle East

Middle Eastern enrollment at US schools fell 9.6% in 2019, the most significant decline among all regions. Two-thirds of the drop was due to a sharp decline in students from Saudi Arabia, by far the region’s largest supplier of international students and the fourth-largest source market worldwide.

Saudi enrollment at American schools fell by 7,922 students in 2019, a 12.9% decline that was the largest among all source countries worldwide. Kuwait, Iran, and Turkey also saw declines of more than 500 students.

Just three countries in the Middle East—Lebanon, Israel, and Palestine—sent more students to the US in 2019 than 2018.

East Asia

With 4 of the top 10 source countries for international students in the US, East Asia is by far the most significant contributor to the American market. Led by China at 31.1%, East Asian countries comprised a 42.1% market share in 2019. Enrollment from East Asia shrunk 1.8% year-over-year.

South Korea posted the biggest decline. 4,796 fewer South Korean students came to the US in 2019, a 5.4% drop. Chinese enrollment decreased by 4,235 students, but this amounted to just a 0.9% decline for what is the largest source market for international students in the US. Japanese enrollment also declined significantly, down 2,200 students (5.6%) in 2019.

The table below shows the 10 largest decreases in US international student enrollment among source countries in 2019:

| Rank | Country | # of Students 2019 | Change 2018–2019 | % Change 2018–2019 |

|---|---|---|---|---|

| 1 | Saudi Arabia | 53,283 | -7,922 | -12.9% |

| 2 | South Korea | 84,071 | -4,796 | -5.4% |

| 3 | China | 474,497 | -4,235 | -0.9% |

| 4 | Japan | 37,196 | -2,200 | -5.6% |

| 5 | India | 249,221 | -2,069 | -0.8% |

| 6 | Venezuela | 11,775 | -1,534 | -11.5% |

| 7 | Kuwait | 11,297 | -1,444 | -11.3% |

| 8 | Thailand | 12,065 | -1,369 | -10.2% |

| 9 | Mexico | 19,517 | -1,186 | -5.7% |

| 10 | Malaysia | 8,746 | -781 | -8.2% |

From the chart, we can see that South Korea, China, and Japan posted three of the top four declines in student enrollment in 2019, combining to send around 11,000 fewer students to the US last year.

Southeast Asia

A smaller market, Southeast Asia accounts for 5.5% of international students in the US. US enrollment from the region dropped by 2,736 students in 2019, a 3.2% decline. Much of this decrease came from Thailand, the second-largest source market in the region. Thai enrollment shrank by 1,369 students, or 10.2%. Vietnam, Malaysia, Indonesia, and Singapore all saw declines as well.

The Philippines was the one major Southeast Asian source market to resist this decline. The number of Filipino students in America grew 0.9% year-over-year.

Interestingly, the number of Filipino students studying in Canada grew by more than 50% to surpass the number of Fililpino students studying in the US last year. This suggests that there’s real potential for growth in the Filipino market, but US schools will have to compete with their Canadian counterparts to capture it.

Myanmar (Burma) and Cambodia also sent more students in 2019, growing their contributions 7.6% and 12.6%, respectively. These countries are smaller markets with longer-term upside.

South Asia

The South Asia market is America’s second largest, with a 19.1% market share. The market declined 0.6% in 2019, driven by a loss of 2,069 students from India. The decline from India is particularly of note in light of the huge increase in Indian students among America’s competition for international students. Both the UK and Canadian markets saw Indian enrollment grow by more than 30% last year.

Bangladesh and Pakistan bucked the regional trend, growing 4.3% and 2.4%, respectively. Each country sent around 10,000 students to the US in 2019 and both have significant growth potential.

Latin America and the Caribbean

The main influx of students to the US market came from Latin America and the Caribbean. Brazil led the way, supplying an additional 3,388 students in 2019. This was the largest increase among all source countries and was good for 9.0% growth year-over-year. Coming on the heels of 11.6% growth in 2018, the Brazilian market’s continued expansion makes it a key point of focus.

Colombia’s numbers increased as well, as did the numbers for Peru, Chile, and a number of smaller markets, including Haiti, Dominica, and Nicaragua. Mexico and Venezuela were the big exceptions. The number of Mexican and Venezuelan students in the US shrank 5.7% and 11.5%, respectively.

The table below shows the 10 greatest increases in US international student enrollment among source countries last year:

| Rank | Country | # of Students 2019 | Change 2018–2019 | % Change 2018–2019 |

|---|---|---|---|---|

| 1 | Brazil | 41,233 | +3,388 | +9.0% |

| 2 | Columbia | 16,350 | +806 | +5.2% |

| 3 | Ghana | 5,092 | +522 | +11.4% |

| 4 | Peru | 5,552 | +455 | +8.9% |

| 5 | Bangladesh | 10,524 | +434 | +4.3% |

| 6 | Kenya | 5,159 | +374 | +7.8% |

| 7 | Pakistan | 9,564 | +224 | +2.4% |

| 8 | Spain | 11,816 | +194 | +1.7% |

| 9 | Russia | 9,196 | +190 | +2.1% |

| 10 | South Africa | 3,302 | +182 | +5.8% |

We see that three of the top four—Brazil, Colombia, and Peru—are Latin American nations. Brazil’s increase stands out among the more modest numbers for the other source markets, but it’s worth noting that it is by far the largest market in the list.

Top Source Countries for the US Market

A review of the major source countries for international students in the US reinforces the decline that we’ve seen across so many regions.

20 of the top 25 suppliers of international students to the American market sent fewer students in 2019 than 2018. Among these, Saudi Arabia, Venezuela, Kuwait, and Thailand all experienced double-digit percentage declines. Italy and Spain joined Brazil, Colombia, and Bangladesh in the positive column.

The table below shows the full list:

| Rank | Country | # of Students 2019 | Change 2018–2019 | % Change 2018–2019 |

|---|---|---|---|---|

| 1 | China | 474,497 | -4,235 | -0.9% |

| 2 | India | 249,221 | -2,069 | -0.8% |

| 3 | South Korea | 84,071 | -4,796 | -5.4% |

| 4 | Suadi Arabia | 53,283 | -7,922 | -12.9% |

| 5 | Brazil | 41,233 | +3,388 | +9.0% |

| 6 | Canada | 38,983 | -15 | -0.0% |

| 7 | Japan | 37,196 | -2,200 | -5.6% |

| 8 | Vietnam | 36,815 | -427 | -1.1% |

| 9 | Taiwan | 32,000 | -226 | -0.7% |

| 10 | Mexico | 19,517 | -1,186 | -5.7% |

| 11 | Nigeria | 19,346 | -154 | -0.8% |

| 12 | Nepal | 17,221 | -186 | -1.1% |

| 13 | Columbia | 16,350 | +806 | +5.2% |

| 14 | Germany | 15,440 | -176 | -1.1% |

| 15 | United Kingdom | 15,091 | -222 | -1.4% |

| 16 | Turkey | 14,790 | -698 | -4.5% |

| 17 | France | 13,865 | -347 | -2.4% |

| 18 | Iran | 12,877 | -728 | -5.4% |

| 19 | Thailand | 12,065 | -1,369 | -10.2% |

| 20 | Spain | 11,816 | +194 | +1.7% |

| 21 | Venezuela | 11,775 | -1,534 | -11.5% |

| 22 | Kuwait | 11,297 | -1,444 | -11.3% |

| 23 | Bangladesh | 10,524 | +434 | +4.3% |

| 24 | Indonesia | 10,268 | -356 | -3.4% |

| 25 | Italy | 10,113 | +23 | +0.2% |

Conclusion

With the election only a few weeks away, there’s a lot of uncertainty in the US international education market right now. A new administration could mean a significant shift in a number of international relationships, which could in turn affect the flow of international students to the US. But some of the trends we’ve observed will undoubtedly continue regardless of the outcome of the election, and of course any shifts that do happen will be in the context of those already occurring trends.

I hope this brief overview has provided some insight on the state of the US market today, and will help inform recruitment decisions moving forward. In the coming weeks, I’ll return to this data to look at market trends by state, school, and student gender. Keep an eye on ApplyInsights.

Subscribe to ApplyInsights

Sign up for the latest insights on international education.

Co-Founder and Chief Marketing Officer (CMO)

Meti is driven by the belief that education is a right, not a privilege. He leads the International Recruitment, Partner Relations, and Marketing teams at �����鶹, working to make education accessible to people around the world. Meti has been instrumental in building partnerships with 1,200+ educational institutions across North America and the United Kingdom. Working with over 4,000 international recruitment partners, �����鶹 has assisted over 100,000 students in their study abroad journey. for more access to ApplyInsights and key industry trends.

FOOTNOTES:

1. Regional labels taken from the . Exceptions: Middle East designation includes UN Western Asia countries except Armenia and Azerbaijan, as well as Iran. Western & Central Europe designation includes UN Northern, Western, and Southern Europe countries, Bulgaria, Czechia, Hungary, Poland, Romania, and Slovakia. Eastern Europe & Central Asia designation includes remaining UN Eastern Europe countries, Central Asia countries, Armenia, and Azerbaijan. South Asia designation does not include Iran.